Blogs

How the Tech Sector Anchors Grade A Office Demand in India

India’s Grade A office market remains structurally supported by the technology sector, which continues to account for close to 40 percent of leasing activity. This is not a cyclical rebound or a post-pandemic anomaly. It reflects India’s entrenched role in global technology and services, the institutionalisation of Global Capability Centres, and a sustained preference for high-quality, professionally managed office assets. For long-term investors, tech-led demand remains one of the clearest anchors of income stability in Indian commercial real estate.

Why HNIs Prefer Real Estate Over Equities in India

Real estate is not just another asset class, it is a strategic anchor for HNIs and long-term investors in India. Rather than replacing equities, it complements them by providing stability, income visibility, and capital preservation.

Key Highlights:

- Predictable Income: Rental or distribution cash flows provide steady returns even during equity market volatility.

- Lower Volatility: Property values and rental income adjust gradually, reducing portfolio swings.

- Inflation Protection: Rental escalations and replacement-cost dynamics help preserve purchasing power.

- Portfolio Diversification: Low correlation with equities strengthens multi-asset allocations.

- Tangible Ownership: Physical, finite assets that support long-term wealth preservation and legacy planning.

- Institutional Access: REITs and InvITs allow professional management, liquidity, and governance without operational complexity.

Real estate offers income, resilience, and long-term value—qualities that equities alone cannot consistently provide.

Hyderabad Real Estate 2026: Income, Growth, and Strategic Forecast

Hyderabad is entering 2026 as one of India’s most structurally balanced real estate markets, offering investors a strategic forecast of income, rental growth, and capital appreciation opportunities. Residential prices are rising in the low-teens, premium homes dominate transactions, and rents in IT corridors are growing close to 20% year-on-year. On the commercial side, office leasing volumes reached multi-year highs led by Global Capability Centres (GCCs), while vacancy has tightened and rents are moving up.

Emerging infrastructure corridors like the Outer Ring Road (ORR), Regional Ring Road (RRR), and Metro Phase II are widening the investable geography, creating a second layer of growth beyond the traditional western IT hubs. For HNI and UHNI investors, this mix of price momentum, rental income, and institutional-grade office demand makes Hyderabad one of the few Indian cities where long-term, income-backed strategies remain highly compelling going into 2026.

India Real Estate 2026: Commercial vs Residential Returns, Risks, and Allocation Framework

India’s real estate market is transitioning from cyclical recovery to structural allocation. For UHNI capital, the commercial versus residential distinction is now framed around risk concentration, capital control, and functional role within the portfolio, rather than asset preference.

For large private portfolios, this distinction increasingly determines not just returns, but the stability of capital across cycles.

Residential real estate anchors approximately 65 - 70 percent of market value and delivers 12 - 16 percent total returns in 2024 - 2025 across select micro-markets, supported by end-user demand and price resilience. Commercial assets continue to offer 7 - 9 percent income yields, but with higher sensitivity to tenant concentration and leasing cycles. Into 2026, capital is increasingly prioritising flexibility, demand depth, and exit optionality, attributes that tend to support more durable outcomes across cycles.

Goa Real Estate Insights: Why North Goa and Anjuna Are Emerging as India’s Luxury Residential Hubs

Goa has evolved from a lifestyle-led second-home destination into one of India’s most structurally resilient luxury residential markets. This blog examines why North Goa has become the state’s residential core, why Anjuna remains a mature and supply-constrained micro-market, and how Saga, an Alt. Investments project developed as a signature project by Aditi Constructions aligns with long-term residential demand trends in Goa.

How Indian Real Estate Is Becoming a Global Investment Destination (2026)

Indian real estate is no longer just a high‑growth domestic story. By early 2026, it has emerged as a global capital allocation destination, attracting strategic capital from domestic and international institutions, broadening asset class breadth, and demonstrating resilient demand fundamentals. Institutional capital deployed into Indian real estate in 2025 hit an estimated USD 10.4 billion, with commercial office assets regaining dominance even as newer investment formats such as data centres and life sciences begin to attract interest.

According to industry reports, India also ranked fourth in Asia‑Pacific for real estate capital inflows in the first half of 2025, signalling its growing relevance among global investors competing for limited high-quality allocations.

Micro-markets and lifestyle destinations are part of this evolving landscape. While core hubs like Mumbai and Bengaluru continue to absorb the lion’s share of capital, cities such as Hyderabad are quickly becoming strategic beneficiaries of global occupier demand. Even lifestyle‑oriented markets like Goa are drawing selective interest from private wealth seeking supply-constrained residential exposure, combining scarcity and lifestyle appeal

Your Guide to Alternative Investments: Real Estate and Portfolio Diversification

Real estate adds diversification by introducing income-linked cash flows and inflation sensitivity. Different investment formats serve different portfolio roles, with trade-offs across liquidity, risk, and control. Over long holding periods, disciplined structure and asset selection tend to matter more than ownership itself.

This guide explains how real estate investment opportunities work in India today, why they matter for portfolio diversification, the primary investment formats available, and how disciplined access and selection play a critical role in outcomes.

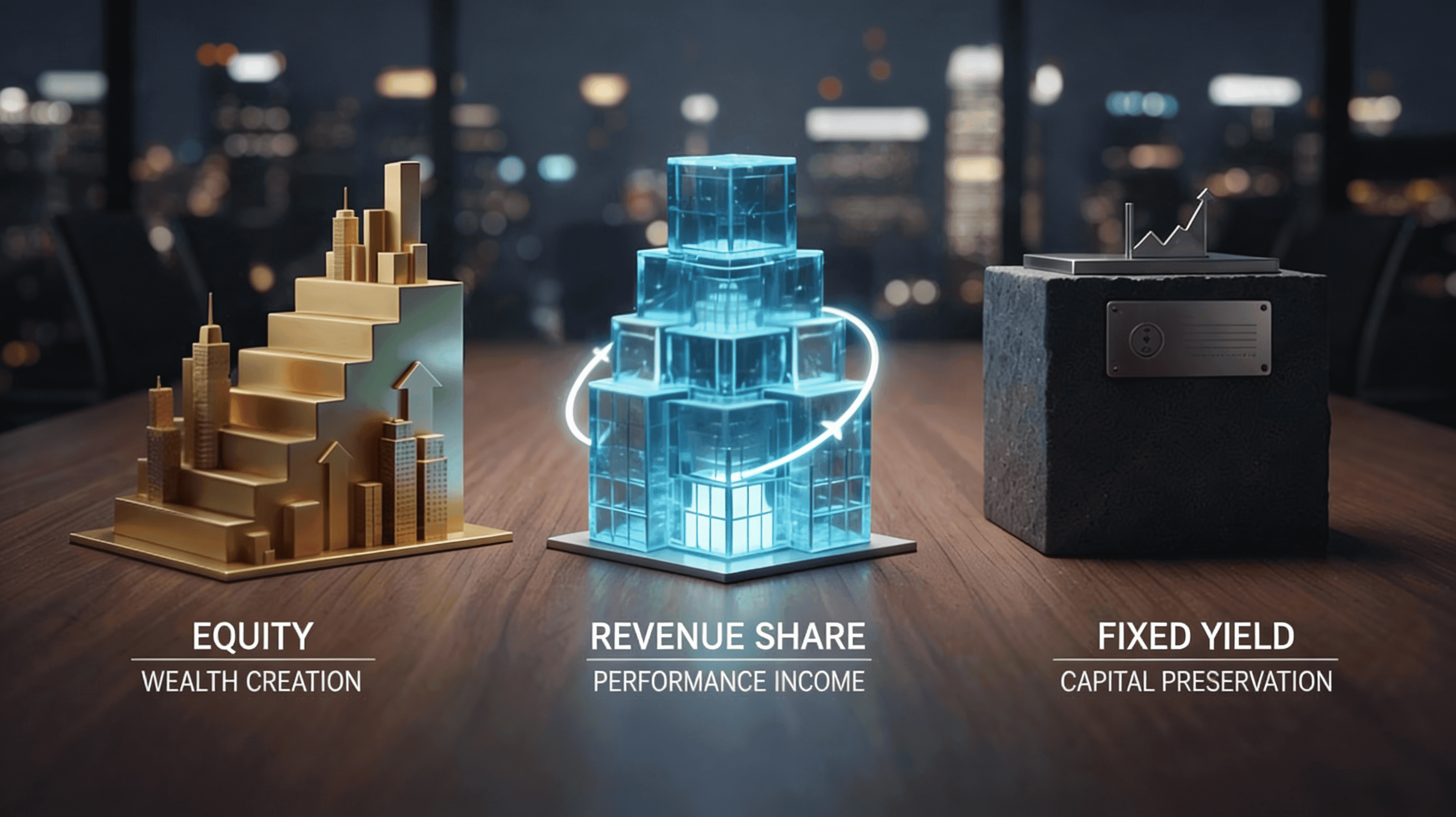

Equity vs Revenue Share vs Fixed Yield: How Serious Investors Choose the Right Real Estate Return Model

This article explains how different real estate return structures actually behave and how experienced investors choose between them.

It compares equity, revenue-linked income, and fixed yield not by projected returns, but by risk exposure, cash flow predictability, and long-term capital outcomes. The focus is on helping investors identify which structure aligns with their investment horizon, income expectations, and tolerance for variability across market cycles.

Rather than advocating a single approach, the blog outlines when each model works best and why serious capital often uses a combination of all three.

Sustainable Luxury: How ESG Is Redefining India’s Premium Real Estate

India’s luxury real estate market has evolved. Ultra-wealthy buyers today seek more than opulence, they value sustainability, efficiency, and future-ready design. ESG (Environmental, Social, Governance) principles have emerged as strategic value drivers, shaping design, operational performance, tenant demand, and long-term wealth preservation.

At Alt. Investments, we approach ESG-aligned premium real estate not as a trend but as a framework for durable value creation, guiding investors to properties that combine luxury with operational efficiency and lasting market relevance.

Cap Rate Compression in Real Estate: How Early Entry Drives Maximum Returns

Cap rate, the ratio of rental income to property price, is a foundational metric for evaluating real estate returns. Yet in high-growth markets, this number only tells part of the story. When property prices rise faster than rents, yields decline, a phenomenon known as Cap Rate Compression.

This signal is especially relevant for HNIs, NRIs, and sophisticated investors. It highlights where early entry can capture both rental income and capital appreciation and where timing the market makes a decisive difference in total wealth creation.

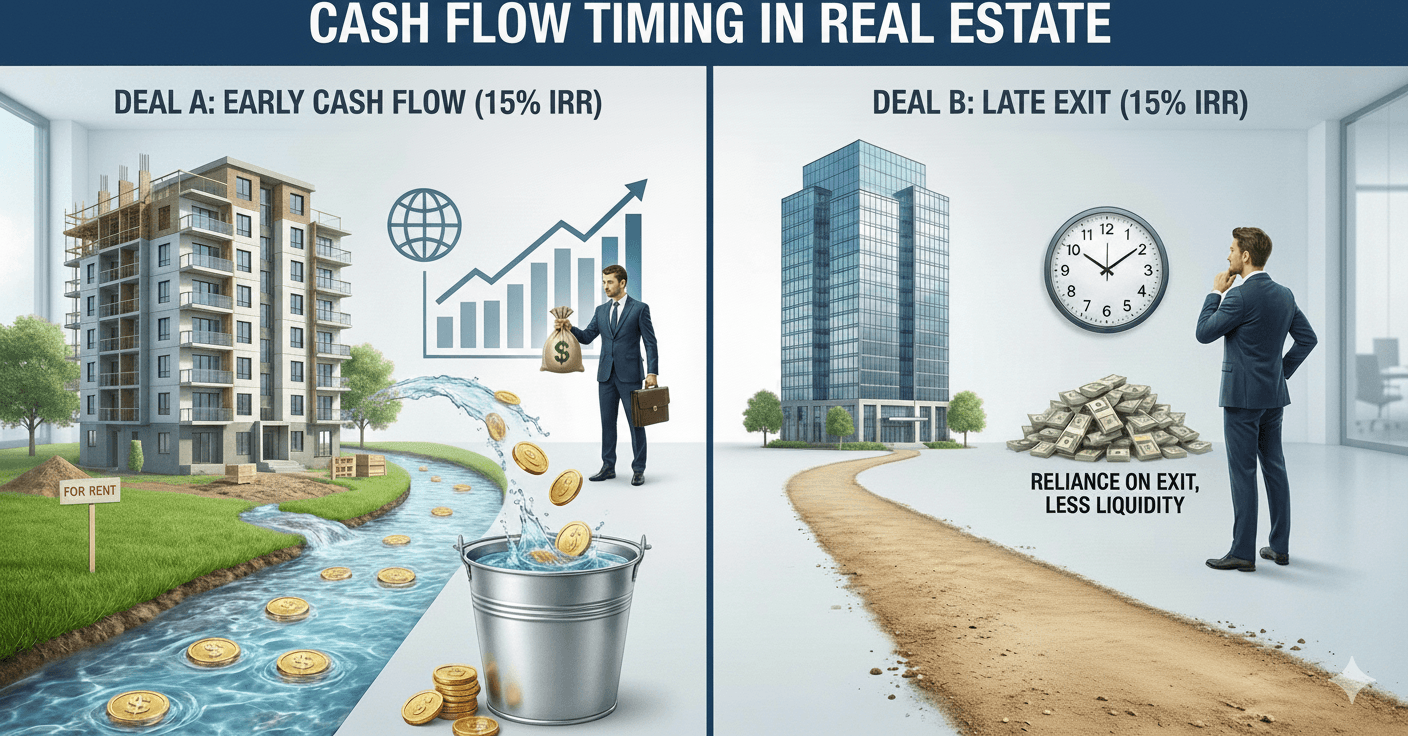

Cash Flow Timing: Why Two 15% IRR Real Estate Deals Are Not the Same

This article explains why IRR alone is an incomplete measure of real estate returns.

Using two investments with the same reported IRR, it shows how differences in cash flow timing change liquidity risk, reinvestment flexibility, and reliance on long-term exits. The objective is to help investors evaluate deals based on when capital is returned and how returns are actually realised, not just on headline percentages.

The core insight is simple: in real estate, when you get paid matters as much as how much you get paid.

Why Adding Private Real Estate Stabilizes Your Portfolio in 2025

Private real estate in 2025 plays a distinct portfolio role. It reduces volatility compared to public equities, generates contract-backed income independent of daily market sentiment, and offers inflation-aligned cash flows supported by real assets. As commercial markets deepen and institutional participation increases, private real estate is increasingly viewed as a core allocation rather than an alternative add-on.

Institutional Grade Real Estate Investing, Now Accessible for HNIs in India

Institutional investors have long mastered the art of disciplined real estate investing. Through careful selection, governance, and risk management, they have built portfolios that generate predictable income and compound wealth steadily across market cycles. Until recently, these opportunities were largely inaccessible to high-net-worth individuals in India. ALT bridges this gap, offering curated access to premium domestic real estate with transparency, protection, and multi-cycle growth potential.

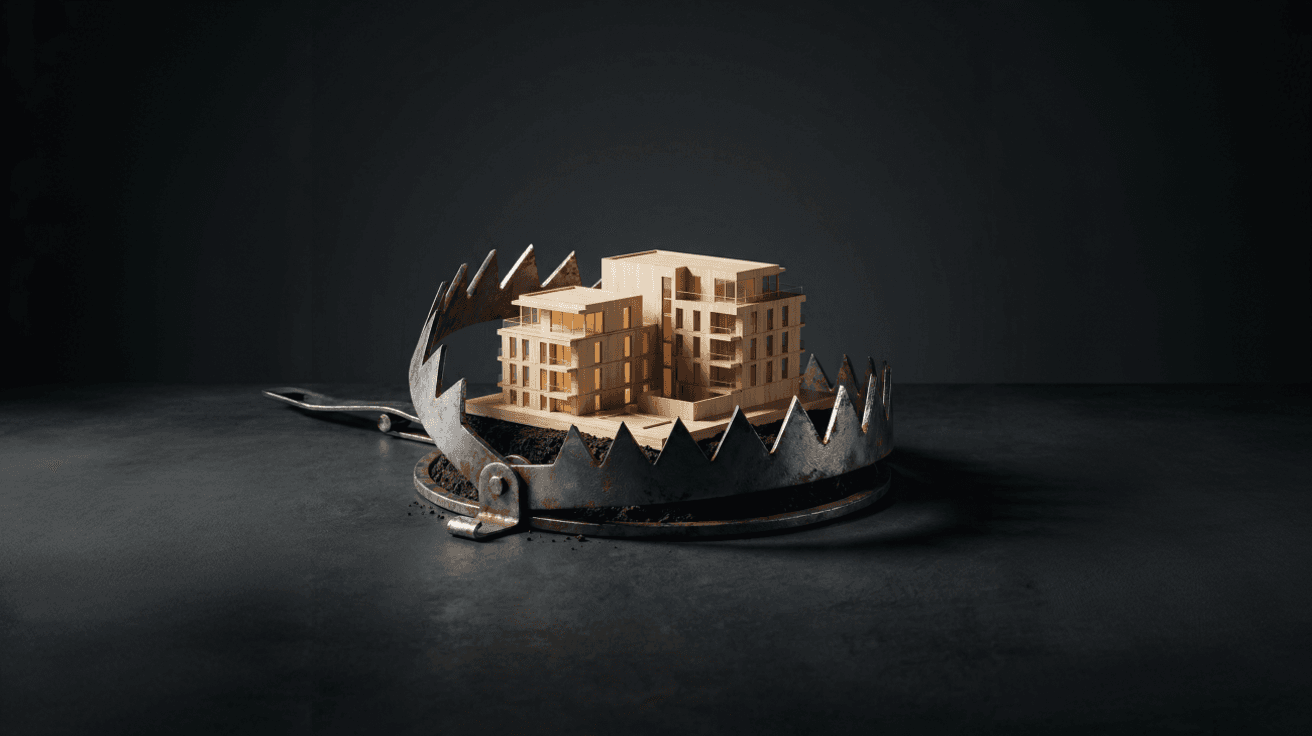

3 Psychological Traps That Can Kill Your Real Estate Returns

This article explores the three most common psychological traps that derail real estate investors. While many focus on numbers and metrics, mindset often has a bigger impact on long-term returns.

By understanding crowd behaviour, overconfidence, and emotional attachment, investors can protect capital, make data-driven decisions, and avoid the subtle pitfalls that erode wealth over time.

Your mindset can make or break your returns.

Real Estate Trends in India 2025: What Is Shaping the Next Phase of the Market

India’s real estate market in 2025 is being shaped by structural demand rather than short-term recovery. Residential real estate continues to dominate volumes, commercial assets are regaining income momentum, and capital flows are becoming more institutional, data-led, and sustainability-focused. Growth is no longer limited to metro cores and is expanding into peri-urban corridors and select Tier 2 and Tier 3 cities. This article outlines the key trends defining the next phase of Indian real estate and what they mean for long-term investors.

Get Started

Start Growing Your Real Estate Portfolio Today

Exclusive opportunities | Fully transparent | Guided end-to-end

No hidden fees | Transparent documentation | Complete guidance